Over 10 thousand baby boomers turn 65 every day, making selling Medicare supplements and Medicare Advantage plans a lucrative career. If you do it right, Medicare sales can be the rewarding challenge you’re looking for. You get to make a difference in the world by helping people get quality healthcare. We can’t think of a better cause.

Overview of Medicare Supplements (Medigap)

Medicare is the public health insurance program created in 1965 allowing retirees to have health insurance even after leaving their employer’s group plan. Anyone aged 65 and older, people diagnosed with ALS or ESRD, and people who’ve received SSDI benefits for at least 25 months are eligible to enroll in Medicare coverage. Many beneficiaries may find that Original Medicare may not cover all of their healthcare needs, and they need to enroll in more comprehensive coverage in the form of Medicare Advantage (MA) or Medicare Supplement (Medigap) plans.

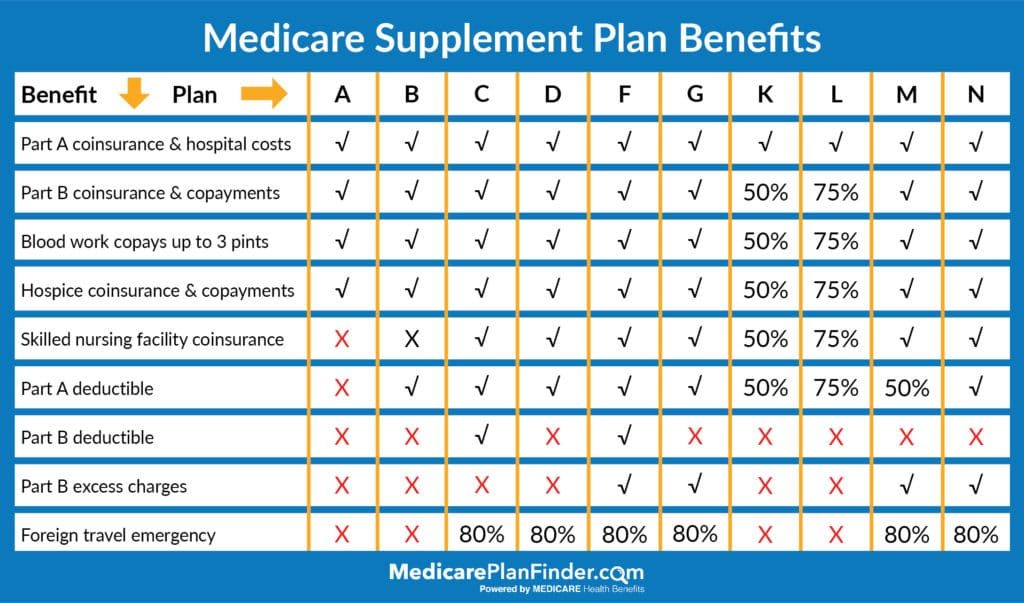

Private insurance carriers offer Medicare supplements to help with many healthcare costs such as coinsurance and deductibles. There are 10 Medigap plans in 2019*, and they offer the same benefits in every state:

*Plan C and Plan G will not be available to anyone newly eligible for Medicare after January 1, 2020. Both plans cover the Part B deductible. Explain to your 2019 clients that if they want a plan that covers Part B deductible, they have to act now.

Is Selling Medicare Lucrative?

Selling Medicare supplements is a great opportunity to serve the underserved senior population and to make money. The Medigap market is two-thirds bigger than the Medicare Advantage market, and the plans are best-suited for people who travel and are financially stable.

One huge advantage of selling Medigap plans is that beneficiaries can enroll in new plans at any point during the year, rather than having to wait for the Annual Enrollment Period (October 15 – December 7). You will get a commission for new enrollments, and some carriers will also pay you commissions if your clients renew.

Maintaining Lead Relationships

It’s important to follow up regularly with your clients and maintain strong relationships. Make sure their coverage still meets their needs, and help them make changes to their plans if they want to. Not only will you help your clients receive great healthcare, but you’ll also get a commission if your clients make changes to their policies during your meetings.

Use your CRM to remind you when to make the initial contact with prospects, and when to follow up with current clients. Your CRM will allow you to make detailed notes about each client interaction so you can tailor your pitch to the individual and make every conversation productive.

The Best Way to Sell Medicare Supplements

Just like with selling any health insurance, Medicare comes with rules and regulations. The first step to selling Medicare supplements is obtaining a license to sell Medicare in your state. The second step is to get AHIP certification. While you don’t need AHIP certification to sell Medigap plans, it’s a great idea to obtain certification. You’ll need it to sell Medicare Advantage plans, and you’ll want to be able to present your clients with a variety of plans and help them choose one that takes all their needs into account.

You should also partner with a FMO (field marketing organization). FMOs make your job easier and let you concentrate on selling, rather than focusing every single administrative and marketing task. A great FMO will provide you with marketing materials, sales tracking software, and a sales team to set you up for success.

The right FMO will provide you with comprehensive Medicare training to give you the right knowledge to best serve your clients. You should be an expert in Medicare before you take your first meeting. At Senior Market Advisors, we take pride in giving our agents the tools and education they need to succeed, including training in the latest Medicare and insurance carrier news.

Medicare Basics

In order to effectively sell Medicare supplements, you should understand how the plans tie into Medicare as a whole. Here’s a general breakdown of Medicare:

Original Medicare

Medicare Part A and Part B make up Original Medicare. Part A is hospital insurance, and it covers inpatient services at hospitals. Part B is medical insurance, and it covers medical expenses such as doctor visits and outpatient treatment. The patient is usually responsible for paying 20 percent of the total Medicare-approved costs, and that’s where Medigap plans come in (hence the name “Medigap”). Beneficiaries can use their Medicare Supplement plans to cover the out-of-pocket “gaps” like coinsurance and deductibles. Medigap plans only cover financial items, not additional health benefits

Medicare Advantage

Medicare Advantage (Part C or MA) plans are private insurance policies that cover the same services as Original Medicare, but some plans come with coverage for additional services such as vision, dental, hearing, meal delivery, and fitness classes. Like selling Medigap plans, selling Medicare Advantage plans can be a lucrative business, and what you sell will depend on the clients’ needs. Beneficiaries cannot have both a MA plan and a Medicare Supplement plan.

Medicare Part D

Original Medicare does not provide prescription drug coverage, and beneficiaries will need to purchase Medicare Part D plans or certain Medicare Advantage plans to cover medication expenses. Medicare eligibles will need to purchase a Part D plan along with a Medicare Supplement in order to have the most comprehensive coverage.

Medicare Supplements Leads for Agents

Use more than one approach to reach potential leads. Email and social media are effective ways to reach your audience if you use the right tactics. Direct mail is still a great way to raise awareness even with the senior population using smartphones now more than ever before. Your leads can come from word of mouth, but be aware that you aren’t allowed to directly ask for referrals. You are allowed to give clients business cards to pass on to friends and family, however.

Start Making Money Selling Medicare Supplements

At Senior Market Advisors, our mission is to serve the underserved. The baby boomer market is all-too-often overlooked, and we want to help seniors live their best lives. When you partner with Senior Market Advisors, not only do you get to make a difference, you get an experienced marketing team, a sales support team and a free CRM to track sales. SMA is committed to helping agents grow their businesses. Ready to contract? Go to our eContracting site to get started today.