Medicare Statistics and Facts You Should Know

Is Medicare a large part of your book of business? Well, it should be, and here’s why. Consider the following Medicare statistics:

Historical Importance of Medicare

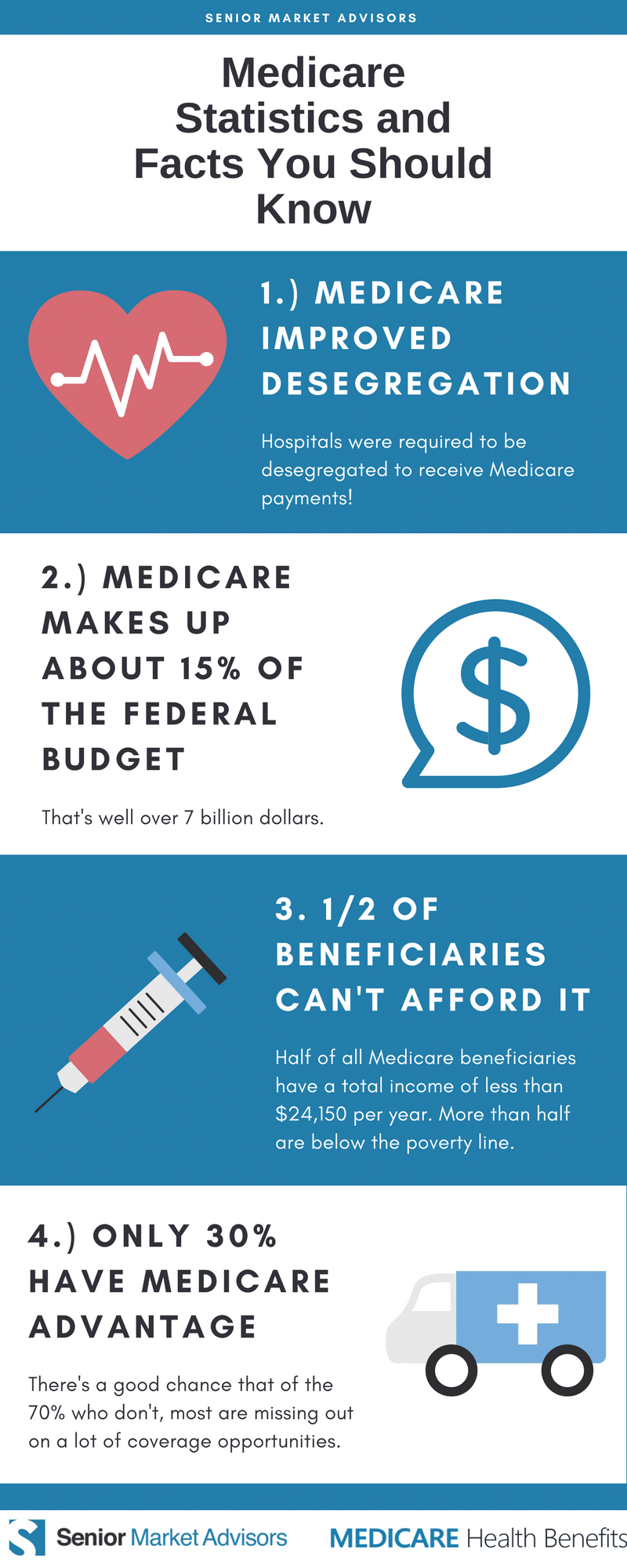

Medicare began in 1965, an incredibly progressive time for America. What you may not know is that Medicare actually played a crucial role in desegregation! Hospitals were required to be racially integrated to receive Medicare payments. Therefore, thousands of hospitals quickly became integrated.

Size & Strength

As of July 2017, Medicare payments were expected to total $709 billion. That’s a large chunk (about 15%) of the national budget. This past spring, there were 58 million people enrolled in Medicare (nearly 18% of the population).

What does this mean? Mainly, it means the market is huge. You won’t run out of people to sell to, especially since thousands of Americans are becoming eligible for Medicare every week.

Financial Facts

Half of all Medicare beneficiaries have a total income of less than $24,150 per year. More than half are below the poverty line.

Before Medicare existed, nearly half of the senior population did not have health insurance. Today, only a very small percentage of seniors are uninsured. Still, you have a huge opportunity to save seniors and Medicare eligibles thousands and thousands of dollars. Plus, of those 58 million people enrolled, only just over 30% of beneficiaries have Medicare Advantage plans. Chances are that most of those people don’t realize how much money they could be saving and how much more coverage they could have. That’s where you become crucial.

Care vs. Coverage

All too often, these words are used interchangeably, but they aren’t the same. Anyone can receive the care they need without having the coverage to pay for it, and anyone can have the coverage they need without reasonable access to quality care.

Speak carefully and with strong details when discussing health care and financial needs with clients. More importantly, always speak clearly about what doctors your client can use with his plan and take that into consideration when helping him choose. Additionally, avoid confusion and unknown fees by outlining every single charge that a client may find with his plan selection.

Recognize the difference between care and coverage and do what’s best for your clients.

Medicare is Important

These facts and figures prove that Medicare is important, which means your job is important. Also, Medicare is confusing. It’s your job to make sure that your clients aren’t “beat by the system.” Help your clients enroll in a plan that truly makes sense for their needs!