Unless you’ve been living under a rock, you’ve probably heard by now that Medicare.gov released a new Medicare Plan Finder tool late this summer. This was the first time the Medicare.gov tool has been updated in a decade, which is crazy considering how fast technology moves.

What’s new with Medicare.Gov’s Medicare Plan Finder?

Medicare.gov’s new search tool creates an entirely new experience for its users. Through the new Medicare.gov tool suite, you and your clients can:

- Compare prices for Original Medicare, Part D, Medicare Advantage, and Medigap

- Compare coverage options from a computer, smartphone, or tablet

- Compare up to three Part D or MA plans at once (side-by-side comparison view)

- View MA and Part D plan benefits

- Use a customized drug list to find Part D plans that make sense

- Use the webchat option for online support

- Use the feedback buttons to share your thoughts and report problems

- Use the transparent pricing tool to find out what procedures will cost with Medicare

- Use the “What’s Covered” app to quickly find out if Medicare will even cover a procedure

New Design

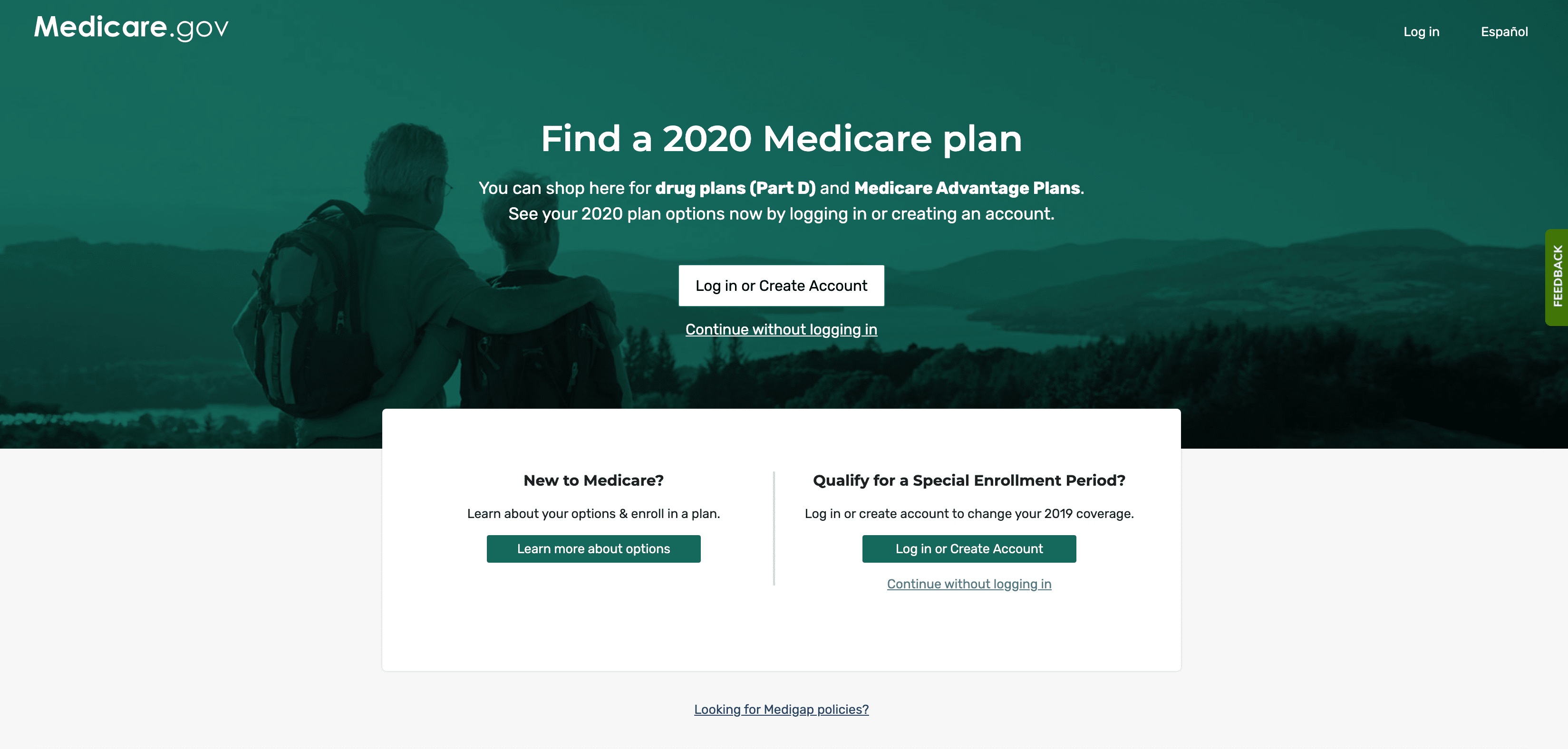

The first thing you’ll notice is that the design has gotten a much-needed facelift. Everything looks much more modern. It’s much more obvious where you need to click.

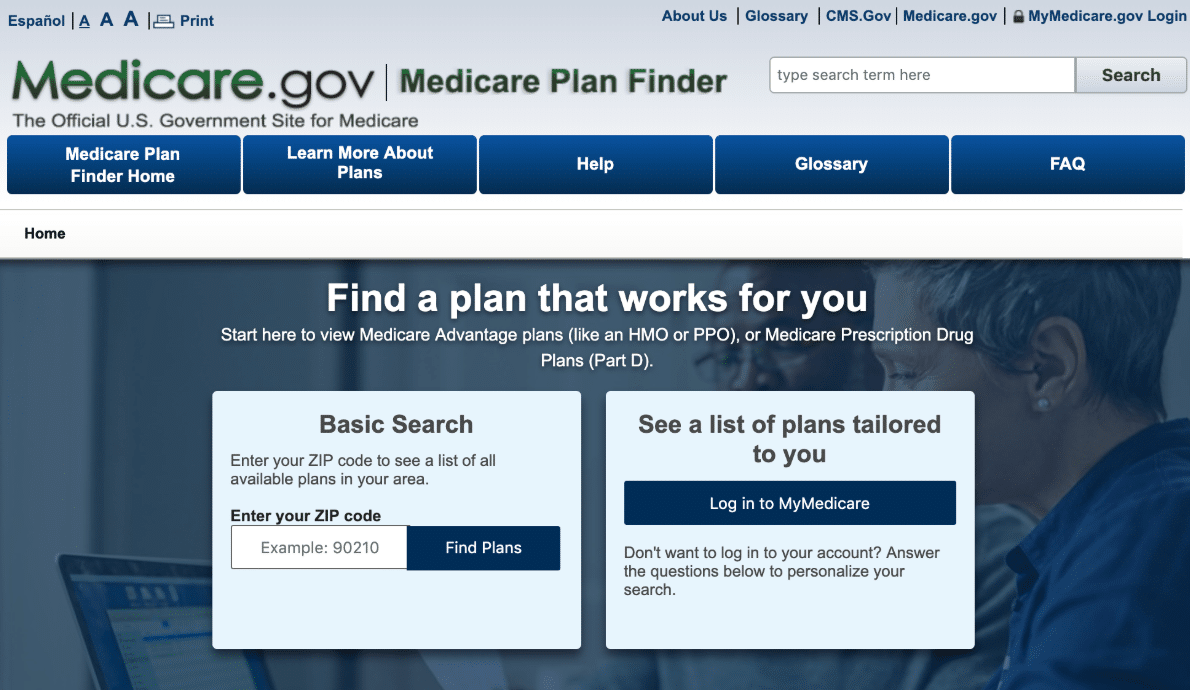

Remember this old one?

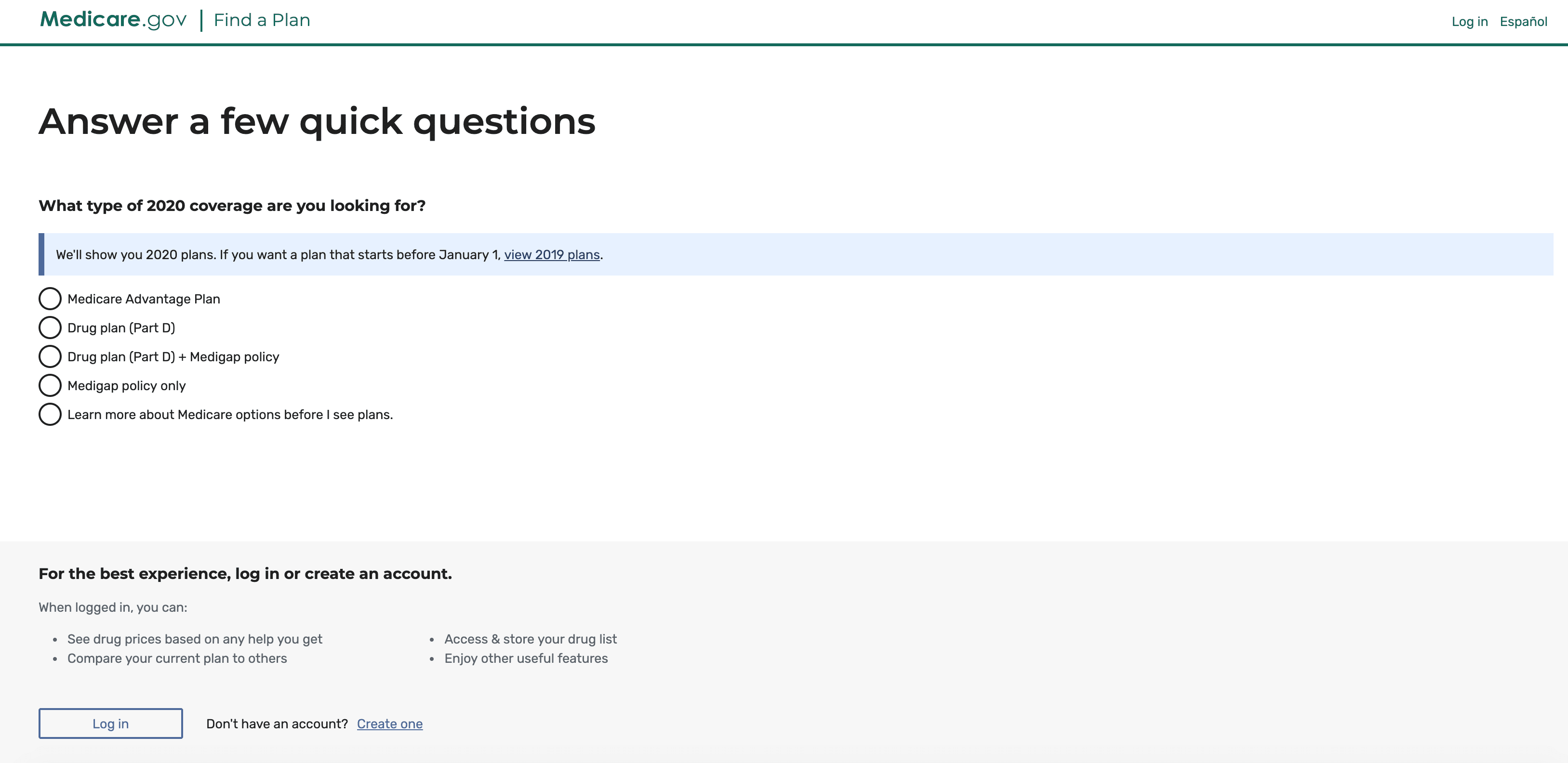

On the new plan finder tool, once you log in or click continue, it’s very easy to navigate. You’ll see a few very brief, non-invasive questions about what you’re looking for.

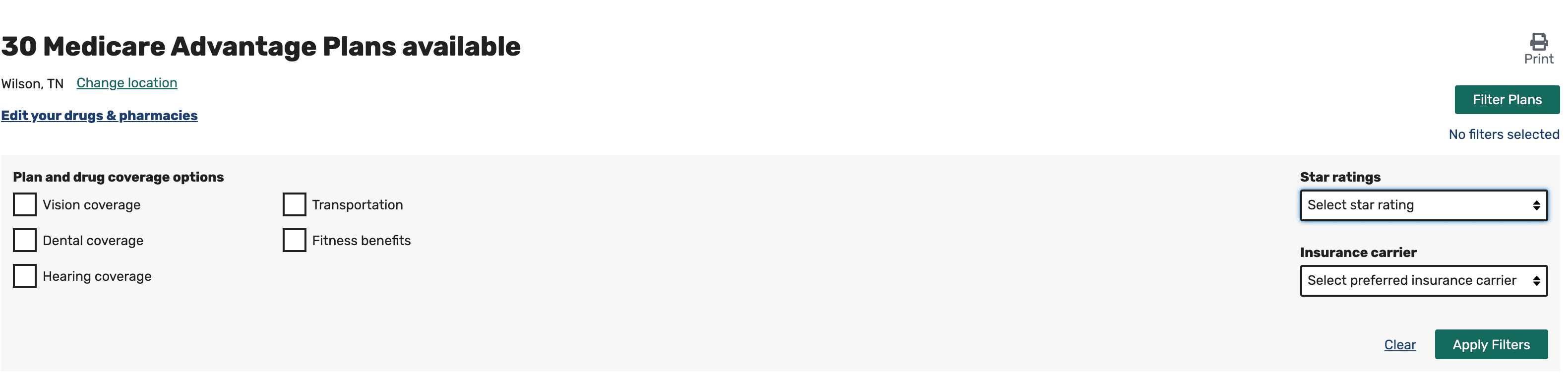

Once you’ve answered the questions, you’ll see a list of plan options available in your area, which you can filter by:

- Star rating

- Carrier

- Whether or not the following is covered:

- Dental

- Vision

- Hearing

- Transportation

- Fitness

Then, you can sort by yearly deductible, drug/premium cost, and monthly premium.

- Lowest yearly deductible

- Lowest drug and premium cost

- Lowest monthly premium

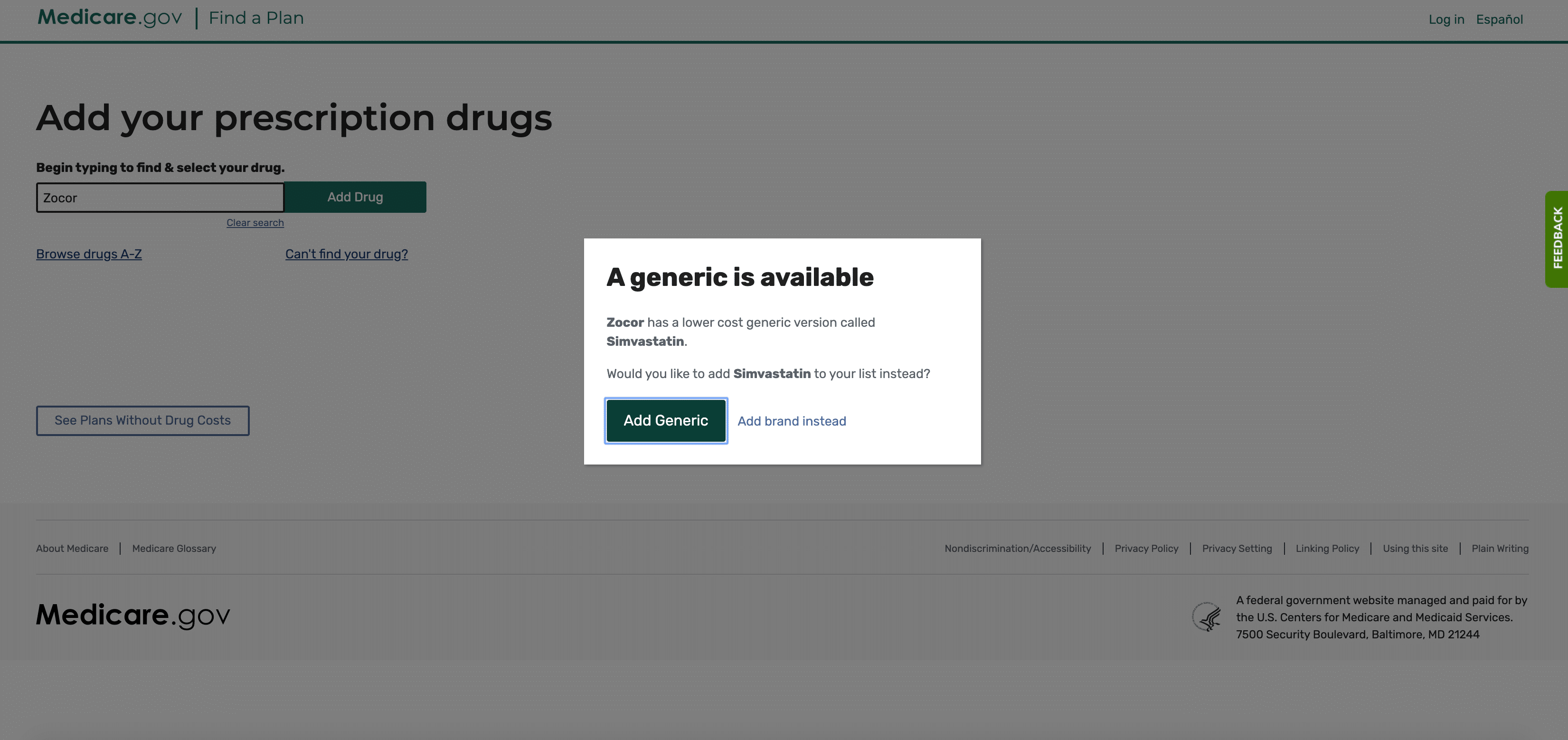

Generic Drug Recommendations

The prescription drug feature has gotten a huge update. It even makes suggestions for generic substitutes for brand name drugs! As a test, we used Zocor, a common brand-name drug used to treat high cholesterol and promote heart health. The tool very quickly populated that we could select the generic version, Simvastatin, instead, as a cost-saving option.

Problems with the new Medicare Plan Finder

Getting to the plan finder from medicare.gov is confusing. If a consumer went to Medicare.gov expecting to see the plan finder, they’d see this:

You may have to point out that they should click on “Find 2020 Health & Drug Plans” to get to the plan finder.

Once you get into the tool, the two main issues that agents are talking about are the new filter options and the lack of saved drug lists from the past.

Plan Filters and Sorting Order

Additionally, the plan filters and sorting order are a bit different. When you start a plan search, it will automatically sort by lowest premium, which, as you may know, may not necessarily be the best plan option. It’s important to not automatically recommend the plan at the top of the list, because the lowest premium may not be what your client is looking off.

You can sort plans by:

- Lowest yearly deductible

- Lowest drug and premium cost

- Lowest monthly premium

Additionally, if you want to see dental, vision, hearing, transportation, and fitness, or if you want to only see certain carriers or star ratings, you’ll have to select that in the gray box at the top of the search results.

Medicare Plan Finder for agents

Drug Lists are Gone

You may have noticed by now that you can’t save client drug lists like you used to! Why? There are no more “drug list IDs” and “password dates.” That info meant that you wouldn’t have to type in every single drug every time you ran a search. With that gone, you won’t be able to run repeated searches for the same client without re-entering drug list information.

Of course, this can all be alleviated if the client creates a MyMedicare.gov account. That’s tricky, because you need to input your Medicare number to do so, which means two things:

- People who are not yet enrolled in Medicare cannot preview the search tool without having to submit their drugs every time.

- People who are overly cautious and don’t want to input their Medicare number won’t be able to search without submitting their drugs every time.

Until AEP ends this year (December 7, 2019), you will be able to find old drug lists by going here: https://www.medicare.gov/find-your-old-drug-list/, but after that, this shortcut will be going away. Be sure to go in and download whatever drug lists you need now, and encourage your clients to do the same. Unless they create an account and save their drug list, this information will be lost and they will have to re-enter everything. For some people, it might not matter – but for those clients who have a laundry list of drugs that they take regularly, it could be quite a hassle.

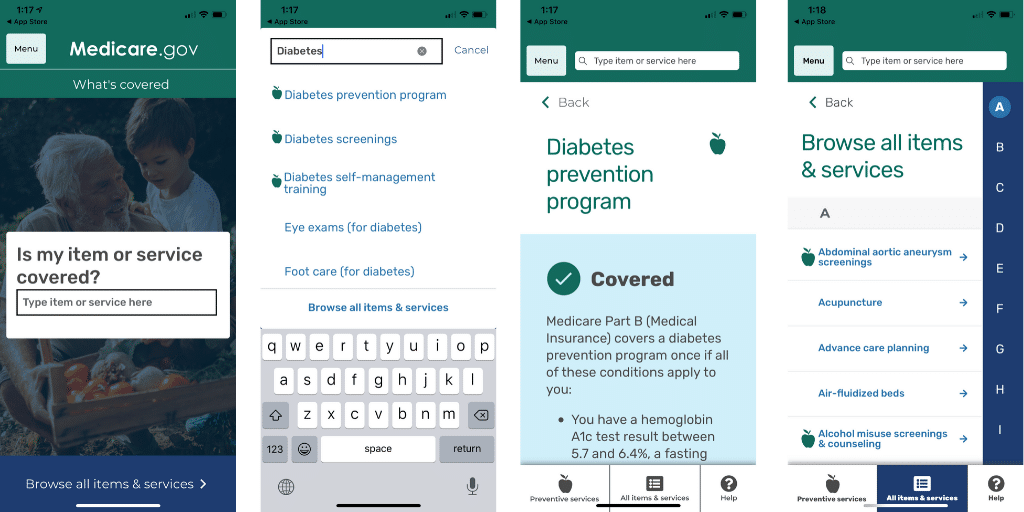

Medicare.gov’s “What’s Covered” App

Tied into this initiative is the new “What’s Covered” app. “What’s Covered” is free to download both on the Apple App Store and Google Play. We downloaded it to an iPhone to show you how it works.

The app is very simple to use. When you open it, you basically have two options: search for the name of a service, or click “browse all items & services.” The “Menu” gives you “about this app,” “more information,” “privacy,” “nondiscrimination/accessibility,” “help,” and “language” (English or Spanish).

If you start by typing a service name into the white box (image one), you’ll get a list of suggestions (image two). When you click on the search result that you were looking for, you get a brief explanation (image three) of how the item or service is covered by Medicare. If you had chosen the blue “Browse all” button instead, or if you clicked “all items and services” at the bottom of your results page instead, you’d see the list in the fourth image below.

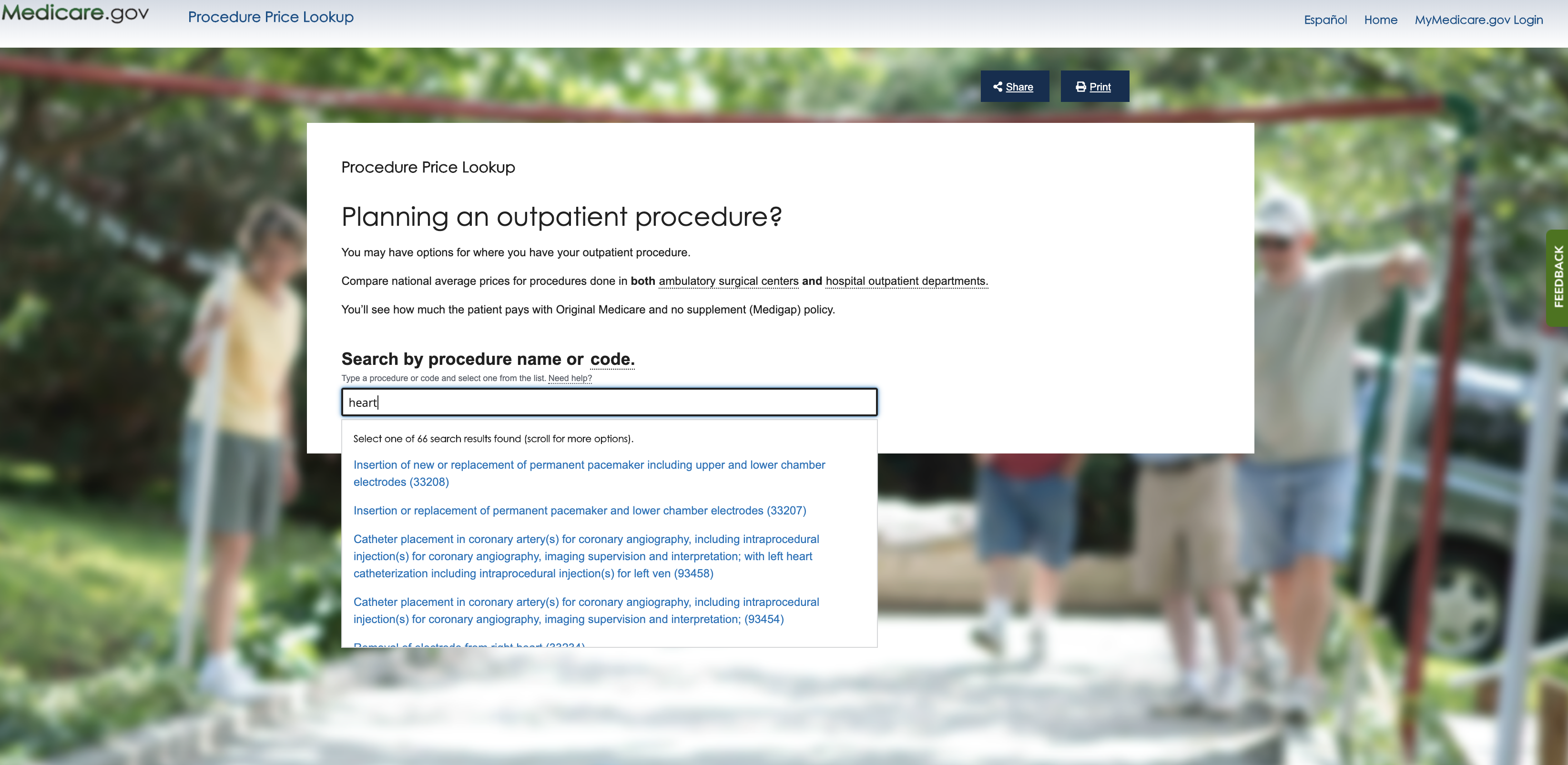

This app is different from the procedure price lookup tool that was released in 2018, though that tool is certainly handy too.

You can find the Procedure Price Lookup Tool here: https://www.medicare.gov/procedure-price-lookup/. To show you an example of how the tool works, we started to type in “heart.” The tool very quickly populated a long list of procedures related to the heart. They are all VERY specific (the first one said, “Insertion of new or replacement of permanent pacemaker including upper and lower chamber electrodes.”

Our Medicare Plan Finder

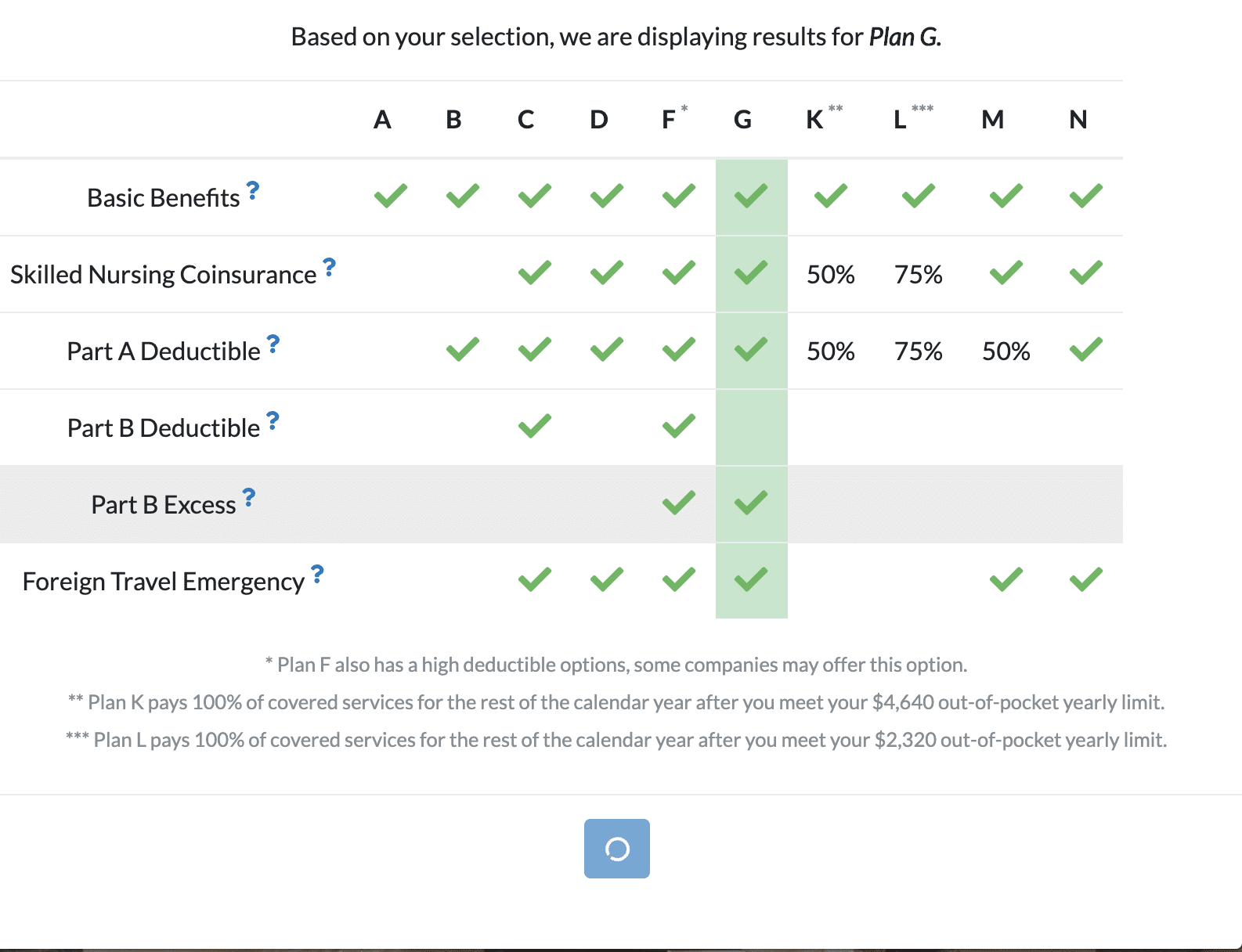

Our Medicare Plan Finder is less of an agent tool and more of a starting point for our leads.

Our tool only shows Medicare Supplement plans right now (though we are working on adding Medicare Advantage/MAPD) and doesn’t have a quick enroll option.

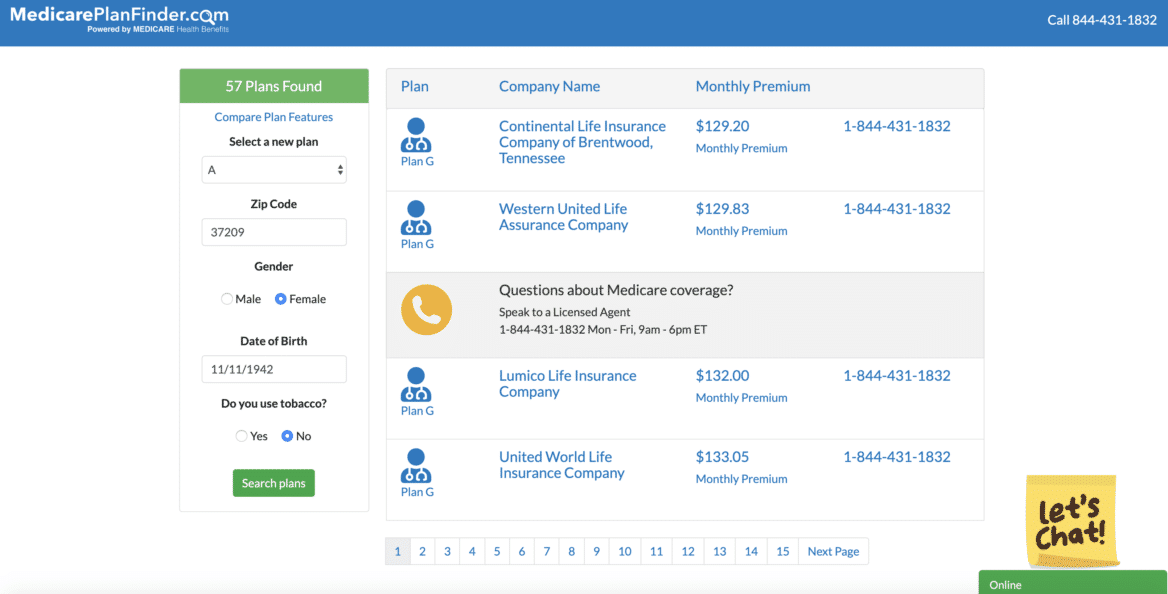

Our tool (found at medicareplanfindertool.com, accessible by medicareplanfinder.com) looks like this:

Once you complete your zip code, gender, age, and whether or not you smoke, you’ll see a suggestion for which Medigap plan letter makes sense for you. Then, you’ll see a list of options for that plan letter in the provided zip code.

The idea is that when a consumer uses our tool and find a plan they’re interested in, they can call us or send us a message and we can get them in touch with one of our licensed brokers.

How to Get Medicare Plan Finder Leads

One of the cool things about our Medicare Plan Finder tool is that it can become a lead generating tool for you.

When you contract through Senior Market Advisors (using our multi-carrier eContracting system nonetheless), you gain access to lead generating tools like our in-house print shop, pre-designed flyers and door hangers, and so much more.

Want to learn more? Complete this form and one of our agency advisors will be in touch. Alternatively, go ahead and give us a call during business hours at 1-844-452-5020.